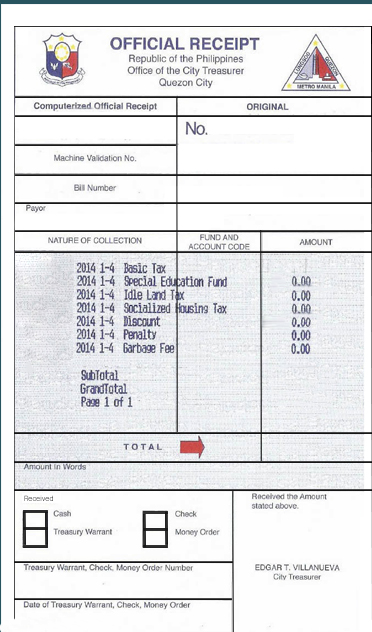

1. Go to the Assessment Lounge for assessment on how much is due. A guard will give you a number depending on the status – Current,

which means your taxes are updated, Senior Citizen and Delinquent, in case you missed payments, whether for one quarter or the whole year.